Indicpay payments is India’s leading payments and API banking company. It helps 1,00,000+ businesses accept and send money and is used for multiple use cases like vendor payouts, wage payouts, bulk refunds, etc.

Choose the product you are interested in. You can switch to Test Environment and try out the product features and integrations using test API credentials. Once ready, you can switch to Production Environment.

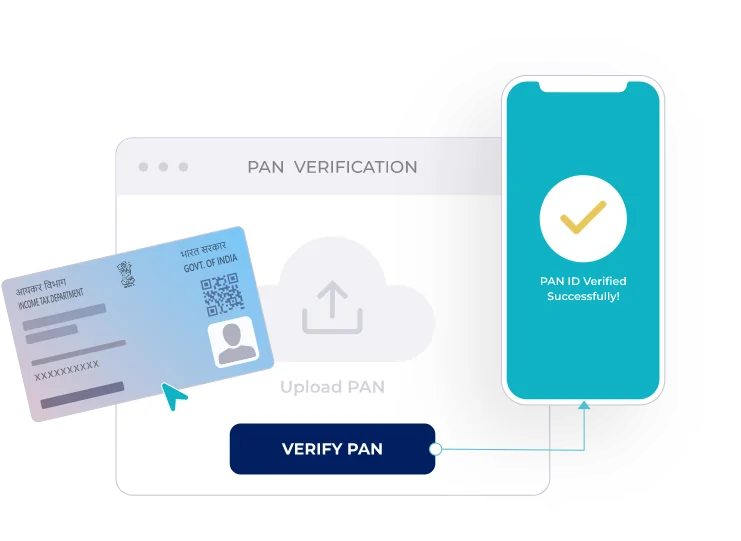

Once your documents are submitted for review, account gets activated with 24 working hours. Please refer to our quick activation guide. You can also write to us at indicpay.com

Indicpay payment Gateway offers 120+ payment modes including Pay Later, Paytm, and Cardless EMI options etc. Indicpay payment Gateway is the only payment gateway that supports instant refunds versus the industry standard of refunds in 5-7 working days - this ensures Cashfree Payments merchants are able to delight their customers while running business operations smoothly.

When you create a Payouts account, Indicpay payments creates a virtual wallet for you. You can add funds from your bank accounts to the wallet and use the funds to do payouts. You can use the Payouts dashboard to do single or bulk payouts via excel upload or integrate Payouts APIs with your product or ERP to automate bulk payouts.